Getty Images

Getty ImagesPre-owned apparel has a strong reputation and is rapidly expanding. However, the economics do n’t make sense, and the majority of businesses are having trouble.

Celebrities are gaining access to the actions through swaps and sales of their pre-owned designer clothes in the last ten years as used style has become commonplace and even become glamorized. Consumers are paying TikTok artists hundreds of dollars for “bundles” of thrifted clothes, and the style sponsor of the well-known American reality show Love Island made the switch from a fast-fashion model to eBay.

Two in five things in Gen Z’s bedroom are pre-owned, according to a review commissioned by ThredUp, the virtual second-hand fashion store, and 67 percent of millennials in the UK purchase second-hand. This statement from ThredUp highlights the market’s unprecedented growth every year since 2017. By 2027, according to the report’s most recent version, the value of the fashion resale market would double to$ 3.5 billion ( £2.76 billion ).

Despite the size of the option, there is a significant issue. It’s difficult to find pre-owned clothes businesses that actually turn a profit, from small thrift shops to massive website second-hand stores.

Online retailers have spent years packing off and shipping out used clothing, with a focus on growth over the bottom line, taking on large cash investments, and occasionally going public. Even for the biggest players in the space, profits are n’t coming in despite this commitment.

thanks to ThredUp

thanks to ThredUpFor example, neither ThredUp nor its leisure cousin The RealReal are successful, deceiving investors, or dragging promote prices below their IPOs. The American peer-to-peer resale website Poshmark was bought by a Korean tech company for$ 1.2 billion ( £950 million ), one-sixth of its IPO valuation, less than two years after going public. The business no longer operates in the UK market, but American consumers and buyers can still use the service.

Vinted, a peer-to-peer fashion resale start-up in Lithuania, has taken over the UK and posted a pre-tax loss of €47.1 million ($ 51 million, £40.3 ) in 2022. Depop, a second-hand retailer in Britain, reported a loss of £59 million ($ 69 million ) in 2023. Vestiaire, which focuses on luxury sale, is the beautiful area. It might be successful by the end of the year if its cheerful forecast is taken into account.

This conflict has an impact on every size, form, and place of distributors. For-profit second-hand garments sorters in the UK have been shut down due to high labor costs and the degrading quality of the goods they receive. Brooklyn residents in New York City complain about getting paid just$ 18 ( £14.20 ) for a full bag of vintage clothing while waiting in line for an hour at the well-known Beacon’s Closet. Market vendors in Ghana, one of the biggest buyers of second-hand clothing from Europe, were likewise complaining about declining value and income as of 2016, and things have onlygotten worse since.

The issue is one of economy. The amount of clothing produced and shipped worldwide continues to rise as a result of the rise of ultra-quick, ultra-cheap fashion brands, and consumers are leaving more of it after a few wears.

One significant Swedish charity is required to pay for the incineration of 70 % of donated clothing because it is too poor to buy in-store or trade, according to a study conducted in 2023. 40 % of garments exported to Ghana is almost instantly recycled.

The Or Foundation, a non-profit that conducts research on Ghana’s Kantamanto business, one of the largest clothing exchanges in the world, claims that there is an oversupply of clothing. And it lowers both the perceived and actual worth of everything.

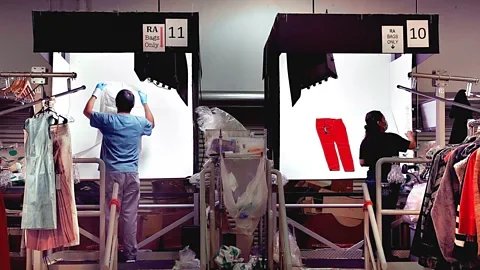

Getty Images

Getty ImagesHidden expenses

Processing second-hand materials requires a lot of labor, and it costs money for businesses. We treat spare as if it were a free source. Sure, you could give it away for completely, but doing so requires a lot of work, work, and skill, according to Ricketts. Reuse is determined by the specific item’s value and situation, which necessitates a human touch and eye to determine that.

Second-hand clothing manufacturers have become aware of the challenging finance involved in selling of used clothing. Some companies are changing their business concepts to buy pre-owned clothing in order to boost profits. While sending along a” Clean Out Kit” was formerly free, ThredUp is now charging both consumers and businesses to approach their used clothing.

According to Dylan Carden, a research analyst with the US-based investment firm William Blair, “you’re doing successfully reverse, single- SKU fulfillment, which is extremely difficult, incredibly expensive, and incredibly inefficient.”

Rising expenses can lead to higher prices, which is jarring for buyers who enter the market looking for bargains and steals. Sometimes, labor costs can cause the cost of second-hand garments to outweigh the cost of brand-new clothes. The Telegraph described thrift shopping as a “right rip-off” in a new research, citing the instance of a used Primark sweater that cost more than a new one.

The sale industry’s ugly secret is that second-hand fashion is frequently subsisted by the purchase of new clothes despite its reputation as an eco-friendly alternative to fast style. For instance, 80 % of eBay items, which have long been viewed as second-hand success stories, are fresh. The strategic partnership with H&M helped the Swedish selling website Sellpy’s expansion to new markets and technology investments, and H&M’s profits come from the sale of significant quantities of fresh rapid fashion.

For second-hand financial to succeed, Thomas Bauwens, an associate professor of social actions and sustainability at the Rotterdam School of Management, thinks we would need to completely reevaluate what we consider to be “good” or “healthy.” In a 2021 article in the Journal of Resources, Conservation and Recycling, Bauwens claimed that businesses that try to implement sustainable practices like take-back, maintenance, selling, and reuse are “quickly outpriced and driven out of the business by cheaper, non-circular rivals.”

A must for culture change

Some experts believe that treating the pre-owned clothes industry as a for-profit enterprise as well as as an environmental imperative is what makes it work.

Getty Images

Getty ImagesAccording to Rachel Kibbe, CEO of the business group American Circular Textiles,” the resale [industry ] as we know it today is in its infancy, not the prudence searching from when we grew up.” She thinks the second-hand apparel market should be funded in the same way other climate-focused initiatives are subventioned for capital-intensive sorting and recycling infrastructure to lower labor costs.

William Blair’s Carden believes that government regulations that mandate companies use particular technologies to lower labor costs may benefit ThredUp and its affiliates. For example, scannable tags on clothing you quickly retrieve information and photos from each item, which would reduce the amount of manual labor needed to sort clothing.

As they introduce efficiency and expand their business models with fresh, state-of-the-art satisfaction centers and technology, these kinds of changes are not only eco-friendly, but they may also help some vendors become profitable.

The other option may be to reduce garments oversupply. If we do n’t reduce the production of new clothes, Ricketts says,” I do n’t see a world where second-hand, upcycled, and recycled products are going to be competitive.” Her organization wants a 40 % reduction in new clothing production as part of a government policy.

Experts believe the current position is unsustainable, whether the second-hand apparel market is a balloon that is about to burst or whether an industry with untapped potential. We need capital, labor, and system, according to Kibbe. ” Because how else are we going to solve this problem known as the weather crisis”?